Note from Lethal Minds:

Bulletin From The Borderlands is a joint project between Lethal Minds and some of the most talented OSINT analysts and independent journalists working today. Our goal is to provide you with a clear, accurate, and informative view of the world, free from censorship or bias. The Bulletin will bring you the facts, our analysis, and our evidence. We hope you find our work helps you better understand the complicated and increasingly volatile world in which we live.

Be informed, be prepared, be lethal.

The Bulletin Team:

Kitbag Conversations : A team of retired Marine and Army Intelligence analysts and the founders of the Croatoan Report and Kitbag Conversations, foreign policy and security affairs podcasts. The Team Leader for Bulletin From The Borderlands.

Analyze Educate : Brodie Kirkpatrick (Analyze & Educate) is a Marine Corps infantry veteran. He attends San Jose State University and is pursuing a Bachelor’s Degree in Political Science. He runs Analyze & Educate, a podcast and associated social media pages discussing geopolitics, armed conflicts, news, and history. In his capacity with Lethal Minds he is the assistant lead for the Bulletin From the Borderlands, Americas Desk chief, and an editor.

Meridian News : Meridian News is a project dedicated to sharing and aggregating open source intelligence, stories from individuals experiencing history, and amplifying underreported global news.

Sino Talk : Sino Talk is China watcher with extensive experience living and studying in China. In another life, he was a Marine intelligence analyst.

The Expeditionary Intelligence Group : The Expeditionary Intelligence Group Instagram page is a project delivering flash news utilizing open-source intelligence combined with human asset contributions and geographic intelligence to provide the general public with objective bias-free global news that tells the whole story based on the facts and on-the-ground insights they feel are missing from a lot of mainstream news reporting.

S2 Forward : A serving US Marine and Intelligence analyst, S2 Forward is focused primarily on the Mid East and Central Asia.

Calisto Report: The Calisto Report is an OSINT project dedicated to delivering timely open source analysis and conflict reporting, and chronicling global events

The Defense Bulletin: Defense Bulletin is run by John M Larrier. As a civilian, I’ve closely followed strategic developments for close to a decade, but “launched” the Bulletin during the pullout in Afghanistan due to the extreme nature of the misinformation I saw my peers as well as others reading into. The lacuna that the general populace has about these now very prevalent subjects is the stated goal for Defense Bulletin

ALCON S2: A veteran of the New Zealand military intelligence community, if it walks, talks, or crawls in Asia, ALCON S2 knows about it. Cole is the preeminent source of OSINT for the Oceania and South East Asia region.

Sponsors

The Bulletin is brought you to by PB Abbate.

As you likely know, Lethal Minds Journal shares common ancestry with Patrol Base Abbate, one of the most impactful veteran’s outreach organizations in America. One of the ways in which we connect is through a love of the written word, a belief in the power of good writing to help give a voice to people who need to be heard, and a desire to help service members and vets connect through self-expression. This summer, Sebastian Junger, award winning writer of War, Tribe, and Freedom (amongst others), will join the Patrol Base Abbate Book Club in Montana for their annual Return to Base Program. From June 22nd-26th, members of the Book Club will spend a few days discussing literature while they reconnect with nature and other veterans at Patrol Base Abbate’s PB in Thompson Falls, Montana. Details about eligibility are at https://www.pbabbate.org/rtb-application-0-0.

The Potential Effects of BRICS within LATAM

Expeditionary Intelligence from the AGIS Group

Introduction:

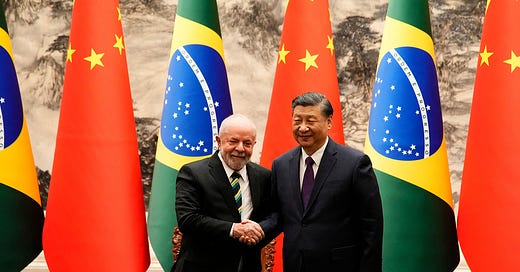

The upcoming BRICS summit on August 22, 2023, in South Africa is garnering international attention. BRICS is now a topic of discussion not just with analysts and politicians but the average person. This is for good reason; BRICS has the potential to reshape global trade dynamics and geopolitical relations. Recently China, Russia, and Brazil (all of which are BRICS countries) have been challenging the US dollar centric world order and promoting themselves as a viable alternative. These countries want to reshape the global economy to better reflect a multilateral system. This message resonates with many emerging economies, this is especially the case in Latin America. Many Latin American countries are seriously considering abandoning the US and the West as partners and joining the BRICS bloc. In this series of articles, we will analyze the implications for each country in Latin America if they were to join BRICS. The first article in this series will focus on Colombia. Colombia's potential integration into BRICS underscores the intricate impacts such a move could have on existing trade agreements and the overall geopolitical landscape in South America. The discussions at the upcoming summit will play a pivotal role in shaping the direction that many countries in Latin America will take.

BRICS is an acronym for the five emerging economies that make up the group: Brazil, Russia, India, China, and South Africa. Starting in 2006, the economic ministers of Brazil, Russia, India, and China met informally at the sidelines of international events (such as the G20 summit) to discuss greater cooperation. It was not until 2009 that the organization held its first formal meeting in Yekaterinburg, Russia. South Africa joined the organization soon after in 2010. This is when the BRICS as we know it today was formed. At the center of this organization is economic cooperation. This includes promoting intra-BRICS trade, investment, and financial cooperation. The group aims to leverage their combined economic strength to foster growth and development within their economies. The organization also has other goals at its foundation, such as political dialogue, social and development initiatives, cultural exchange, and, most importantly, global governance reform.

Originally, BRICS was not an economic organization but rather just a term. In his 2001 report, “Building Better Global Economic BRICs,” Goldman Sachs economist Jim O'Neill created the term BRIC to characterize Brazil, Russia, India, and China as the largest emerging economies at the time. O'Neill believed that these countries were poised to become the world's leading economic powers in the 21st century. He predicted that the BRIC countries would account for more than 40% of the world's gross domestic product (GDP) by 2050. His predictions were quite accurate, since 2001 the BRIC countries have all experienced rapid economic growth. According to the International Monetary Fund (IMF), the BRIC countries (Brazil, Russia, India, and China) account for 31.55% of the global GDP based on Purchase Power Parity (PPP) in 2023 . Jim O'Neill’s report was one of the factors that led to the meeting of the BRIC countries. These countries also met because they shared several common interests and they felt that they were being excluded from the decision-making process in the global economy. The economic ministers of Brazil, India, Russia, and China began meeting informally to negotiate closer economic ties and cooperation. These informal meetings laid the groundwork for the first formal meeting in Yekaterinburg, Russia 2009. This meeting was held in response to the 2008 global financial crisis. The BRIC countries used the meeting to discuss ways to address the crisis and to promote their shared interests in the global economy. Other topics that were discussed at the meeting include: strengthening cooperation on issues of common interest, such as climate change and security, promoting shared interests in the global economy, such as trade, investment, and development, and finally the creation of a formal organization that would allow them to cooperate more closely. Every year since 2009, BRICS has held a summit. The head of state of the host nation chairs the BRICS summit, which rotates between the five member states every year. This year, as South Africa is the summit’s host nation, the current President Pro Tempore of BRICS is South Africa.

There are currently five members of BRICS. However, as of 2023, many countries have expressed interest in joining or have formally applied. Argentina and Iran both signaled their intent to join BRICS during meetings with senior Chinese officials. At the time, in 2022 China was President Pro Tempore of BRICS. There is no specific criteria or application process to join BRICS. A state only requires the unanimous backing of all founding member states. Ahead of the upcoming BRICS summit on August 22, 2023, South Africa’s top diplomats claimed that over 40 countries are interested in joining, with 20 already formally applying. Among these are Latin American countries such as Mexico, Argentina, Venezuela, and Uruguay. Many other Latin American countries, besides the countries listed here, cooperate closely with BRICS on numerous projects and trade agreements.

While BRICS may have initially been formed as a way for the world's emerging economies to foster growth and investment, the organization has become so much more. Russia and China are using the organization to change the Western-dominated world order established post-collapse of the Soviet Union. These states are attempting to form a bloc of countries to challenge the supremacy of the dollar as the world's reserve currency. In 2022, the BRICS economies accounted for 31.67% of global GDP (based on PPP), 18% of global trade, and 25% of foreign investment. Due to this economic power, BRICS can exert significant geopolitical influence. This is especially the case for developing economies which may feel that the West exploited them in the past. By exercising influence over many developing economies, BRICS can significantly change the face of the global economy and isolate the West from important trade and investment opportunities.

BRICS Case Study #001: Colombia

Analyst(s): Rick “Rickynomics” Alonzo Munoz

Introduction:

Colombia's integration into the BRICS consortium could reshape its trade landscape. This analysis delves into the implications of this integration, focusing on its influence on existing trade agreements and the broader geopolitical context.

Impact on Current Trade Agreements:

United States-Colombia Trade Promotion Agreement (USTPA):

Parties Involved: United States, Colombia

Nature of Agreement: The USTPA promotes bilateral trade by granting duty-free access to Colombian goods in the U.S. market.

Impact:

• Colombian coffee, a global favorite, might encounter challenges if the U.S. introduces tariffs due to geopolitical shifts. Brands like Café Devoción, which prides itself on sourcing beans directly from independent Colombian coffee producers and delivering farm-fresh coffee to New York in a record time of 10 days post-harvest, and Juan Valdez, a symbol of Colombian coffee culture, can capitalize on their reputation to cater to the expanding middle class in BRICS countries.

• Several prominent American brands, including Levi's, Gap, Tommy Hilfiger, American Eagle, Ralph Lauren, Macy's, and Calvin Klein, source their products from Colombian manufacturers. These brands often import fabrics from the U.S. duty-free and then export the finished jeans products back to the U.S. market. The production in Colombia encompasses both basic and specialized jeans products. Three major companies in the Medellín area, CI Jeans, Globo, and Expofaro, dominate the jeans manufacturing sector, primarily producing for the U.S. market. Medellín's flourishing textile sector, a significant contributor to Colombia's exports, could face changing dynamics. Firms like Crystal SAS, a premier denim manufacturer, and Fabricato, a textile industry stalwart, will need to navigate this evolving environment, potentially exploring new markets or adapting their product lines.

If Venezuela and Colombia are in BRICS:

• Strengthened Economic Ties and Diversification: If both Venezuela and Colombia were to join BRICS, their mutual trade agreement would likely lead to strengthened economic ties, given the shared objectives and interests within the BRICS framework. With the backing of BRICS, both nations could diversify their trade portfolios, reducing over-reliance on traditional trade partners. For instance, Venezuela, with its vast oil reserves, could secure more stable oil contracts with BRICS nations, reducing its dependency on volatile global oil markets. Similarly, Colombia could expand its agricultural and manufacturing exports to BRICS countries, fostering economic growth. The combined strength of Venezuela and Colombia within BRICS could position them as key players in South American trade dynamics.

• Enhanced Infrastructure and Investment Opportunities: A joint membership in BRICS would likely attract significant infrastructure investments to Venezuela and Colombia. BRICS nations, particularly China, have shown a keen interest in investing in infrastructure projects in member and partner countries. With a mutual trade agreement, Venezuela and Colombia could jointly propose and benefit from projects like transnational highways, energy pipelines, or port developments. Such projects would boost their economies and enhance connectivity and trade efficiency between the two nations. Furthermore, the presence of BRICS-backed infrastructure could make the region more attractive for foreign investments beyond BRICS.

• Political Alignment and Regional Stability: Being part of BRICS would necessitate Venezuela and Colombia to align on various political and economic policies. This alignment could improve diplomatic relations, especially given the historical tensions between the two nations. With the support and mediation of BRICS, Venezuela, and Colombia could resolve longstanding disputes, leading to a more stable South American region. Additionally, their joint membership could counterbalance other major regional powers, ensuring a more equitable distribution of regional influence. Over time, this political alignment could pave the way for more collaborative efforts in areas beyond trade, such as defense, technology, and environmental conservation.

Analyst Comment:

A trade agreement between Venezuela and Colombia within the BRICS framework would have multifaceted impacts, ranging from economic growth to political alignment. Such a partnership would not only benefit the two nations but could also reshape the geopolitical and economic landscape of South America. This could result in a departure from access to international defense funds and natural resources provided by western nations which Colombia would need to factor into their entry to BRICS.

Colombia Trade Promotion Agreement (COTPA):

Parties Involved: Colombia, United States

Nature of Agreement: COTPA, similar to USTPA, offers duty-free access to Colombian goods in the U.S. market.

Impact:

• Colombia's thriving floral sector may discover new markets within BRICS nations, potentially impacting the U.S. floral market, which heavily depends on Colombian imports. This could lead to potential price adjustments or sourcing changes in the U.S. its floral market under the Colombia Trade Promotion Agreement (COTPA) with the United States will undergo significant changes. Within the BRICS framework, Colombia might establish closer trade ties with member nations, opening up new markets for its vibrant floral industry. Countries like Russia and China, with their vast consumer bases, could become lucrative destinations for Colombian flowers. However, this shift towards BRICS nations might reduce the dependency on the U.S. floral market, which currently relies heavily on Colombian imports. As a result, the U.S. floral industry could face potential price adjustments or sourcing changes. Additionally, the introduction of competitive floral products from BRICS nations into Colombia might influence domestic market dynamics. In essence, while new opportunities in BRICS nations will emerge for Colombian flowers, the traditional trade patterns under COTPA with the U.S. might be redefined.

• Colombian emeralds, valued worldwide, could attract a new clientele in BRICS countries, influencing U.S. market dynamics. This shift in demand could influence the U.S. market dynamics, potentially affecting prices and trade volumes. Within the BRICS framework, Colombia could witness a shift in demand for its emeralds, as these precious gems might find a different set of admirers in member countries such as India and China. This change in demand could influence the dynamics of the U.S. emerald market, which currently imports Colombian emeralds. The introduction of alternative sources of emeralds from BRICS nations might lead to adjustments in pricing and trade volumes.

Pacific Alliance:

Parties Involved: Colombia, Chile, Mexico, Peru

Nature of Agreement: The alliance aims to bolster economic integration and free trade among its members.

Impact:

• Chile's wine exports to Colombia could compete with South Africa's emerging wine industry, leading to market share battles and potential price wars. If Colombia were to join the BRICS consortium, Chilean wines could face a price disadvantage compared to South African wines in the Colombian market. Colombia might benefit from preferential tariffs or reduced trade barriers with member countries, including South Africa, within the BRICS framework. This could make South African wines more cost-competitive in Colombia. Additionally, enhanced supply chain efficiencies and potential geopolitical considerations could further tilt the balance favoring South African wines. Consequently, Chilean wine exporters might need to reevaluate their pricing strategies to retain their market share in Colombia.

• Mexico's auto industry might face heightened competition from BRICS countries, notably China and India, known for their automotive manufacturing prowess. If Colombia and Mexico were both to join the BRICS consortium, the Colombian automotive market would witness heightened competitiveness. The integration would pave the way for a surge of Mexican vehicles, given Mexico's robust automotive industry, leading to a richer diversity of vehicle offerings in Colombia. This influx, combined with vehicles from traditional BRICS nations, would saturate the market with options ranging from luxury to budget-friendly models. Furthermore, the deepened regional trade agreements and supply chain integration between Colombia and Mexico would enhance the availability and affordability of auto parts and components. Such a scenario would compel existing players in the Colombian automotive sector to innovate and adapt, ensuring they remain relevant in an increasingly competitive landscape.

Andean Community:

Parties Involved: Colombia, Bolivia, Ecuador, and Peru

Nature of Agreement: The community focuses on economic integration and development.

Impact:

• Ecuador, a major banana exporter, might compete with Brazil for the Colombian market, potentially affecting trade volumes and prices. If Colombia were to join the BRICS consortium, Ecuador's banana trade with Colombia could face challenges. Within the BRICS framework, Colombia might benefit from preferential trade agreements with member nations, potentially leading to competitive pricing or favorable trade terms for imports from countries like Brazil. As Brazil is a significant banana producer, it could offer bananas at more competitive rates or with added trade incentives to Colombia. Consequently, Ecuador, currently a major banana exporter to Colombia, might experience reduced demand or be compelled to adjust its pricing and trade strategies to retain its market share in the face of intensified competition.

• Bolivia's quinoa exports to Colombia could be challenged by alternative BRICS suppliers, leading to a reevaluation of trade strategies. If Colombia integrates into the BRICS consortium, Bolivia's quinoa trade with Colombia might undergo shifts. Within the BRICS framework, Colombia could establish preferential trade agreements with member countries, potentially leading to increased imports of alternative grains or commodities. Given that countries like India and China have diverse agricultural products, they might introduce competitive alternatives to quinoa in the Colombian market. As a result, Bolivia, a primary quinoa exporter to Colombia, could face challenges in maintaining its current trade volumes and might need to recalibrate its export strategies to ensure continued market dominance in Colombia amidst growing competition.

Mercosur:

Parties Involved: Colombia (associate member), Argentina, Brazil, Paraguay, and Uruguay

Nature of Agreement: Mercosur promotes regional economic integration.

Impact:

• Brazil could enhance its beef exports to Colombia, potentially impacting Argentina's market presence. This might lead to Argentina recalibrating its export strategies to maintain its market share. If Colombia integrates into the BRICS consortium, Argentina's beef exports to Colombia will face heightened competition from Brazil, a major beef exporter within BRICS. This preferential positioning for Brazil will challenge Argentina's market share and exert downward pressure on beef prices in Colombia. Argentine beef producers must diversify their strategies to retain their foothold in the changing trade landscape.

• Paraguay's soybean exports to Colombia might face competition from Brazil, which could offer competitive prices or trade incentives. Brazil, a dominant player within BRICS and one of the world's largest soybean producers, will have an advantageous position in the Colombian market due to potential preferential trade agreements or reduced tariffs. This advantage for Brazil will significantly challenge Paraguay's soybean exports, potentially reducing its market share in Colombia. The heightened competition might also lead to price adjustments. Consequently, Paraguay will need to reconsider its export strategies, possibly focusing on value-added soy products or securing alternative markets to counteract the influence of Brazil in the Colombian soybean market.

Colombian Corporate Investment Strategies for Navigating the BRICS Landscape:

• Grupo Nutresa: Grupo Nutresa, initially founded in the early 20th century, has evolved through various transformations, once known as Inversiones Nacional de Chocolates S. A., then Grupo Nacional de Chocolates S. A., and now as Grupo Nutresa S. A. As Colombia's leading processed food company, it commands a 53.7% market share and stands as a pivotal player in Latin America's food sector. The company operates eight diverse business units, including Cold Cuts, Biscuits, Chocolates, Coffee, Tresmontes Lucchetti (TMLUC), Retail Food, Ice Cream, and Pasta, with cold cuts and biscuits being its primary revenue drivers. With a direct footprint in 17 countries and international sales reaching USD 1.32 billion across over 82 countries, Grupo Nutresa showcases its global reach. Ambitiously, the company aims to double its 2020 sales by 2030 while ensuring returns surpass the cost of capital. Recognized for its sustainability efforts, Grupo Nutresa was ranked as the world's most sustainable food company in the Dow Jones Sustainability Indices (DJSI) 2021, marking its eleventh consecutive year on the list.

Furthermore, according to MERCO Empresas, it holds the distinction of being the second-most reputable Colombian company. With a diverse product range, from coffee to chocolates, Grupo Nutresa is well-positioned to cater to BRICS consumer preferences. Given the diverse culinary tastes across BRICS nations, there's a potential for products like coffee, chocolates, and other processed foods to find a receptive audience.

• Avianca Holdings: The airline can play a crucial role in bridging Colombia with BRICS nations, given its extensive routes across the Americas. The airline's adaptability will be crucial in navigating the shifting geopolitical landscape, including understanding regulatory changes and potential partnerships with airlines in BRICS nations. However, any potential integration with BRICS would likely consider Avianca's financial health (since it's codesharing agreement with United Airlines), its recent history of mergers and acquisitions, and its strategic alliances.

• Bancolombia: Bancolombia, founded on January 29, 1875, as "Banco de Colombia," stands as a premier financial institution with a rich heritage. Operating across Colombia, Panama, El Salvador, Puerto Rico, the Cayman Islands, Peru, and Guatemala, it is Colombia's largest bank in terms of assets and shareholders' equity. Serving over 25 million customers in Colombia and Central America, Bancolombia offers a comprehensive suite of financial products and services, spanning commercial banking, trust, and investment banking. The bank operates across nine distinct segments, reflecting its diverse service offerings. As of 2022, Bancolombia reported a revenue of US$4.3 billion and total assets of US$50.5 billion, supported by a workforce of over 31,900 employees. Notably, it is a key player in the COLCAP index, representing its significant influence in the banking sector. Its strong international operations make it a prime candidate to establish ties in BRICS nations. Bancolombia could explore partnerships with banks in BRICS nations, offer specialized services for businesses trading between Colombia and BRICS countries, and provide financial products tailored to investors' needs.

• Alpina: Alpina Productos Alimenticios S.A. BIC, founded in 1945 by Walter Goggel and Max Bazinger in Sopó, Colombia, is a leading Colombian dairy, food, and beverage company. With its headquarters in Sopó, Cundinamarca, Alpina boasts a diverse range of beverages, milk, baby food, desserts, cheeses, cream, butter, and finesse products. As the third-largest dairy producer in Colombia, the company has achieved sales exceeding US$700 million. Beyond its domestic operations, Alpina has a significant presence in Venezuela, Ecuador, and the United States. Given potential shifts due to BRICS, the company should strategize to maintain its market position within Mercosur. Collaborations or partnerships with distributors or retailers in BRICS nations could enhance Alpina's market reach.

• Tecnoglass Inc.: Based out of Barranquilla, Colombia. Tecnoglass Inc is a leading manufacturer of architectural glass, windows, and associated aluminum products for the global commercial and residential construction industries. The company serves the multi-family, single-family, and commercial construction industries. Tecnoglass also produces aluminum products, such as profiles, rods, bars, plates, and other hardware used to manufacture windows. The company is publicly traded on the New York Stock Exchange under the ticker symbol TGLS. As construction and infrastructure projects grow in BRICS nations, there is a potential demand for high-quality architectural products.

• Grupo Argos: Grupo Argos is a global holding company based in Medellín, Colombia, with a diverse portfolio of infrastructure investments in strategic sectors. The company is a reference infrastructure holding company in the Americas and a leader in the cement business with a unique investment structure on road and airport concessions. Grupo Argos has three subsidiaries, including Cementos Argos (cement), Celsia (energy), and Odinsa (road and airport concessions). The conglomerate might find new opportunities in BRICS-led development projects, especially in infrastructure. Collaborations or partnerships with construction companies in BRICS nations could enhance Grupo Argos's market reach.

• Grupo Sura: headquartered in Medellin, Colombia, is a prominent Latin American investment manager established in 1997. Publicly traded under the stock symbol GRUPOSURA, the company is renowned for its long-term vision of building a balanced portfolio centered around financial services. While its primary investments lie in finance, pension, insurance, and social security, Grupo Sura also has interests in the processed food, cement, and energy sectors. The company strategically targets innovative businesses that offer complementary services to its core holdings. Operating domestically and internationally, Grupo Sura has a significant presence in the financial services, industry, and corporate venture sectors. As of May 16, 2023, its primary engagement is in the life insurance sector. Grupo Sura's tailored insurance and asset management products will be essential for investors as the economic landscape transforms. The company's understanding of the regulatory environment in BRICS nations and its technological infrastructure will be key determinants of its success in these markets.

Analyst Comment:

Colombia's potential integration with the BRICS countries presents unique opportunities and risks. On the one hand, the country benefits from increased access to foreign markets, improved political and economic stability, and a more competitive economy due to greater competition from other BRICS nations. On the other hand, factors such as foreign defense aid and financial retaliation from non-BRICS nations could weigh heavily against the potential benefits of expanded trade possibilities.

Variables in Colombia's Decision Making to Joining BRICS

Analysis of the Impact of Colombia's Integration into BRICS on U.S. Defense Funding

Background: The U.S. has historically provided significant military aid to Colombia, primarily to combat drug trafficking and insurgent groups. This aid has been a cornerstone of U.S.-Colombian relations, with the U.S. viewing Colombia as a critical ally in the fight against drug production and trafficking in the region.

Potential Impacts of Colombia's Integration into BRICS on U.S. Defense Funding:

• Reassessment of U.S. Strategic Interests: Colombia's alignment with BRICS could lead the U.S. to reassess its regional strategic interests. BRICS nations, particularly China and Russia, have often been at odds with U.S. foreign policy objectives. If Colombia were to prioritize its relationships with BRICS nations over its relationship with the U.S., it could reduce U.S. defense funding to Colombia.

• Shift in Defense Priorities: U.S. defense funding to Colombia primarily focuses on counter-narcotics operations. However, suppose Colombia's integration into BRICS leads to increased economic development and stability in the country. In that case, the U.S. might shift its defense priorities from counter-narcotics to other areas, potentially affecting the amount and nature of defense funding.

• Diplomatic Implications: Colombia's closer ties with BRICS nations could lead to diplomatic tensions with the U.S., mainly if Colombia adopts foreign policy stances that are at odds with U.S. interests. This could result in the U.S. leveraging its defense funding as a diplomatic tool, either by reducing funding to express disapproval or by offering increased funding as an incentive for Colombia to align more closely with U.S. objectives.

• Economic and Geopolitical Dynamics: The broader economic and geopolitical dynamics at play could also influence U.S. defense funding to Colombia. For instance, if U.S. businesses see increased opportunities in Colombia due to its BRICS membership, the U.S. government might increase defense funding to ensure regional stability. Conversely, if U.S. businesses face increased competition from BRICS nations in Colombia, it could lead to decreased U.S. interest in the region and a potential reduction in defense funding.

• Security Concerns: One of the major concerns for the U.S. has been the potential for increased drug trafficking and related security issues if defense funding to Colombia is reduced. However, if Colombia's BRICS membership leads to increased economic opportunities and stability, it could reduce the need for U.S. defense funding focused on counter-narcotics operations.

Analyst Comment:

Colombia's potential integration into the BRICS consortium could have significant implications for U.S. defense funding to the country. While the exact impact is uncertain and would depend on various economic, geopolitical, and diplomatic factors, such a move would necessitate a reassessment of U.S./Colombian defense relations. The U.S. must carefully consider its regional strategic interests and adjust its defense funding priorities accordingly.

IMF's Investments and Loans to Colombia:

Colombia's collaboration with the International Monetary Fund (IMF) traces back to 1999, a crucial period during which the country grappled with a severe recession. In response, the IMF extended a significant loan of $2.7 billion to aid Colombia's recovery efforts. The loan was accompanied by a series of structural reforms, including adopting a flexible exchange rate system and establishing an inflation target. This partnership marked the inception of Colombia's ongoing association with the IMF.

A noteworthy development occurred in 2009 when Colombia secured access to a notable financial cushion through a $10.5 billion flexible credit line from the IMF. Designed to bolster the confidence of international investors, this credit line exemplified Colombia's commitment to sound economic management. It is worth noting that Colombia refrained from utilizing this credit line, underscoring its dedication to prudent financial practices.

World Bank's Investments and Loans to Colombia:

In the more recent context of 2022, the World Bank emerged as a key collaborator in Colombia's pursuit of equitable development. Notably, the World Bank sanctioned two distinct loans. The first, amounting to $750 million, centered on a comprehensive spectrum of policy enhancements. The objectives included:

• the augmentation of household equity and resilience,

• the dismantling of barriers obstructing women's economic participation,

• bolstering climate change mitigation and adaptation endeavors, and

• the facilitation of biodiversity conservation.

In parallel, the World Bank's second loan, totaling $80 million, set its sights on a sector of utmost significance—education. This endeavor aimed at refining pedagogical practices within Colombia's educational landscape. The foremost goals encompassed the elevation of learning achievements and the reinforcement of socio-emotional learning, reflecting a holistic approach to educational development.

Analysis:

Hypothetical Figures:

For the sake of analysis, let's consider hypothetical cumulative figures:

IMF: $13.2 billion (accumulated since 1999)

World Bank: $830 million (comprising loans from 2022)

Potential Impact of Colombia's Integration into BRICS on These Investments and Loans:

Economic Factors:

As Colombia envisions an entry into the BRICS consortium, a notable economic dynamic comes into play. The diversification of funding sources emerges as a palpable prospect. Integration with BRICS could open avenues to alternative funding, reducing Colombia's reliance on traditional financiers like the IMF and World Bank. This diversification could enhance financial resilience and flexibility.

Moreover, the augmentation of trade relationships with fellow BRICS nations bears implications for Colombia's economic landscape. Improved trade dynamics could stimulate economic growth, potentially bolstering Colombia's creditworthiness and influencing the terms and conditions of its existing loans.

Geopolitical Factors:

Colombia's potential pivot towards BRICS introduces a significant geopolitical undercurrent. This shift in alliances may be perceived as a departure from its traditional affiliations with Western powers. The altered geopolitical landscape could consequently impact the tenor of investments and loans, particularly those intertwined with institutions where Western influence holds substantial weight.

Furthermore, BRICS membership might imbue Colombia with the capacity to foster regional stability. This newfound stability could manifest as an attractive investment environment, creating a virtuous cycle that bolsters economic prospects.

Diplomatic Factors:

The prospect of Colombia's integration into BRICS carries potential diplomatic implications. Negotiating leverage in financial matters could experience a notable transformation. With the backing of BRICS, Colombia might be poised to assert enhanced leverage in negotiations for new loans or restructuring existing ones.

In policy recommendations, the involvement of institutions like the IMF often correlates with prescribed economic policies. However, with the influence of BRICS, Colombia might opt for alternative economic approaches, potentially deviating from recommendations stipulated by the IMF or World Bank.

Analyst Comment:

In a landscape where concrete figures are hypothetical, the ramifications of Colombia's potential entry into BRICS stand as a convergence of economic, geopolitical, and diplomatic factors. As Colombia navigates this decision, its financial relationships with the IMF, World Bank, and the USA are poised for transformation, unveiling an intricate interplay of interests and dynamics that will shape its economic trajectory in years to come.

Overall Assessment and Analysis of Colombia’s Likelihood of Joining BRICS:

The complexity of this assessment stems from the fact that BRICS does not adhere to a clearly defined structure, making it challenging for Western nations to formulate a definitive counter-strategy to prevent countries from simultaneously engaging in Western trade agreements and BRICS. An arrangement akin to inviting Colombia as an associate member, mirroring the Mercosur trade agreement, could offer a viable solution. Such an approach might enable Colombia to exploit the benefits of such an arrangement without attracting significant scrutiny from the US and Europe, thereby avoiding potential trade retaliation in the form of sanctions and tariffs.

The likelihood of Colombia's decision to join BRICS hinges on the responses of the US and Europe. Should the US maintain a hands-off approach, refraining from implementing punitive trade measures, it is probable that Colombia would lean towards membership. Conversely, if the US and Europe adopt strong positions against BRICS and its member nations, Colombia might opt to keep a cautious distance while preserving its informal trade partnerships with BRICS countries.

In the present context, Colombian policymakers will likely weigh the prospect of joining BRICS against the stability and solidity of the arrangement itself. Their decision-making process will be guided by a nuanced assessment of the international trade landscape, considering various factors before determining whether to pursue membership.

Lethal Minds is a reader-supported publication.

Our monthly subscription is : $5

Our annual subscription is : $2.50 a month

Group subscriptions are available at a 25% discount per seat